VJSE2013 第6回ベトナム・日本学生学術(科学)交流ミーティングにおけるグェン・フン・クォツ先生の基調講演を掲載いたします。

Vietnam: a Developing Economy

At a Crossroad

Quoc Hung NGUYEN

School of Economics, University of Hyogo

Outline of This Talk

1. Economic Performance since Doi Moi

2. Causes of Recent Economic Turbulence and Recession

i. Unsustainable Growth Model

ii. Inefficiency

iii. Inappropriate Macro Policy Response

3. Current Economic Situation

4. Very Recent Developments and Perspectives

Economic Development Since Doi-Moi

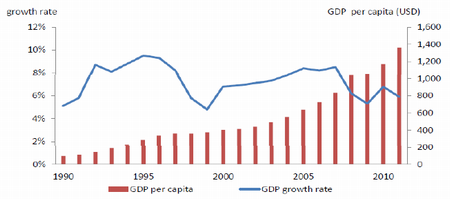

➢ Impressive Economic Performance for 20 years

■ Economic growth rates average at 7.3% per year

■ GDP per capita increases more than 10 times

・ FYI: In terms of GDP per capita adjusted for PPP, Vietnam was among the 20 poorest countries in the world in 1990.

– With GDP per capita of US$98 , Vietnam was indeed the poorest one. The next two poorest countries were Somalia (US$139) and Sierra Leone (US$163)

・ Successfully joined the lower middle income group (US$935~3705) in 2008

・ Poverty rates reduced from 58.1% in 1993 to 11% in 2009

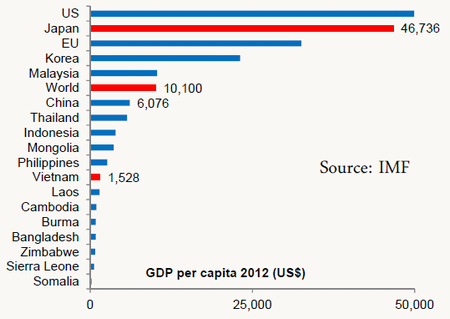

➢ Still pretty poor!

■ 1/4 of China, 1/6 of the world average

➢ The economy has recently got sick after lots of turbulence

・ Growth rates dropped to 5.0%, worst since the Asian crisis in 1998

・ # of bankruptcy soared: 50,000 (2011); 51,000 (2012); 39,400 (2013~date)

・ Many people get very pessimistic.

・ WHAT WENT WRONG?

Causes of Recent Economic Recession

➢ Unsustainable growth model since 1998:

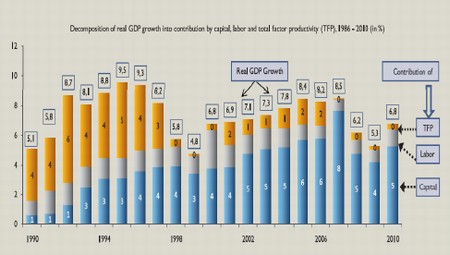

■ Economic growth comes from: labor, capital, and productivity/technology

■ Growth since 1998 based mainly on rapid capital accumulation not productivity improvement

・ By contrast, the contribution of productivity (TFP) to growth was very high during the beginning of Doi Moi (Left Figure)

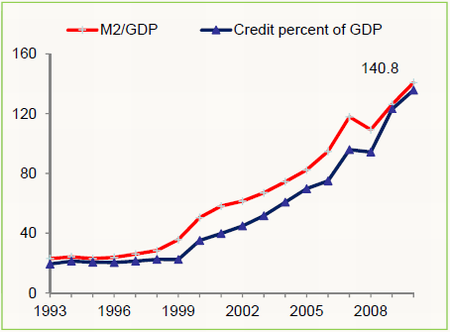

■ Rapid growth has been supported by overly expansionary monetary policy

・ The ratio of money supply and credit over GDP increased from 30% to 140% (Right Figure)

Source: Vietnam Development Report 2012

Source: Vietnam Development Report 2012

Weakness of the Banking System

➢ Due to an easy licensing policy and very expansionary monetary policy, Vietnam faces the problem of over-banking

■ Too many banks for an economy of US$100 billion: 5 state-owned commercial banks, 37 joint-stock banks, 4 foreign joint venture banks, 5 foreign banks, 54 foreign bank branches, and more than 1000 people credit institutions (by 2012)

・ FYI: Osaka City real GDP is about US$200 billion

■ Due to imprudent supervisory framework and growth pressure, many of newly founded small banks lack sufficient risk management and have become highly exposed to risk from real estate and securities markets

■ The cross-ownership problem: banks are owned by other banks and by large business groups and large SOEs

・ A report by the World Bank shows that JSBs with larger state ownership often have greater exposure to SOEs by lending more to SOEs: Unhealthy because within group lending often have problems of imprudent evaluation and supervision

■ The economy got over-dependent or addicted to bank credit

Widening Saving Investment Gap

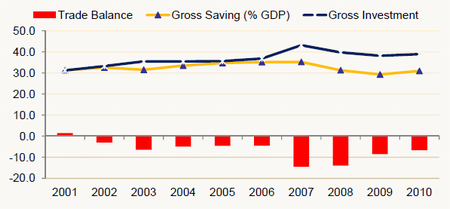

➢ Due to rapidly expansionary investment, there is a widening gap between saving and investment in Vietnam

✓ The mirror of this gap is a significant trade deficit

➢ The gap has been financed by external sources such as FDI and ODA with the cost of being vulnerable to external economic and political shocks and turbulences

➢ High rates of investment but the efficiency of its investment, particularly those of SOEs and public sector is a concern

人気記事

-

VNLオリジナル 2013年9月01日